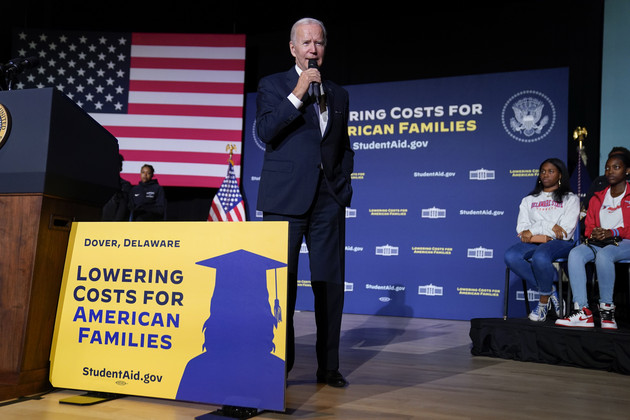

Following a substantial blow from the Supreme Court in late June, the Biden administration has successfully found alternative ways to eliminate billions in education debt. In Biden’s original plan, he projected to forgive up to $20,000 in education debt for 43 million borrowers, totaling $400 billion in federal student loan forgiveness.

However, in a 6-3 vote, the Supreme Court struck down this plan, calling it unconstitutional.

Despite the complications, this hurdle did not prevent the government from relieving millions of borrowers’ debt. In what is known as the largest student debt cancellation since receiving government support nearly 60 years ago, the Biden administration has successfully eliminated $3.6 million of borrowers’ debt, totaling $127 billion.

After countless administrations, student loan relief has finally started to see changes.

The programs Biden used to initiate these changes have existed for many years. The obstacles that hindered the success included vague and unclear qualifications, strict requirements, and incompetence in the Department of Education.

The education department hired loan servicers to keep track of borrowers’ monthly payments, with the hopes of providing those borrowers with better income-driven repayment options once they qualified. However, due to these loan servicers neglecting to keep track of the borrowers’ monthly payments, many borrowers did not know they were eligible for income-driven payment options. Therefore, ultimately, borrowers missed out on income-driven options that could have substantially reduced their total payments.

To combat this, the Biden administration automatically applied adjustments to borrowers’ accounts who they believed qualified for the 20-year income-driven payment plan — no application required. Further, the administration temporarily waived some qualifications and implemented a few additional relief programs. These programs included one that eliminated debt for borrowers who attended closed schools, another that canceled debt for borrowers who are permanently disabled, and lastly, one that erased debt for borrowers who worked for a government agency or nonprofit organizations and completed 10 years of monthly loan payments.

Much less broad than Biden’s original plan, these programs have affected a more specific group of people. Many of them are not recent college graduates. Hence, these programs had little to no benefit for recent graduates.

“Biden’s program will help people who aren’t millennials,” said Jana Connelly, a 2022 accounting graduate of Florida A&M University. “Everything created will only benefit borrowers who accumulated loans for 10 years or more. We have to struggle until we qualify, with hope the rules don’t change in the process.”

These programs, more specifically, do little for first-generation college graduates who statistically borrow more than second-generation college graduates.

According to a 2021 Pew Research Center study, 65% of first-generation college graduates owed $25,000 or more in student loans, compared with 57% of second-generation college graduates.

To prevent loans from being a financial burden upon graduation, student loan counselors encourage students to start paying off student loans while in college. However, this method is not feasible for many first-generation students.

“School and financially supporting myself through school came first; paying back my student loans was an afterthought,” said first-gen graduate Arianna Curry, a 2023 general health science graduate of Florida A&M University. “I didn’t have the privilege to have financial support outside my income. On top of supporting all my other necessities such as bills, food, and gas to survive, the only money I had left would have to last me until my next paycheck,” Curry said.

With the cost of living rising, finding yourself in an economic hardship has been a reality for many Americans, regardless of whether they are or are not a first-generation college graduate.

While the Biden administration is heading in a better direction than what we have seen for many years, we must acknowledge that millions of Americans are still waiting to qualify for a relief program. In America, 43 million borrowers owe the government $1.3 trillion. Thus, many are waiting for their chance to qualify for relief.