College students across the country have not been so lucky when it came to receiving a stimulus check.

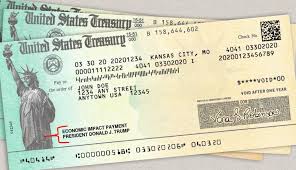

The first stimulus checks were sent out in March of 2020 in the amount of $1200. The second stimulus checks started going out in January in the amount of $600. A third stimulus check is projected for $1400 some time in March.

This leaves many college students with the questions: Why am I not eligible to get a stimulus check? How can I receive a stimulus check in the future?

According to the Internal Revenue Service, you aren’t eligible for a payment if you were claimed as a dependent on another taxpayer’s 2019 tax return. This is where most college students are ruled out because they are still claimed on their parents’ taxes.

“I didn’t know at first why I didn’t get a stimulus check but I later found out it was because I was claimed as a dependent. As college students we should receive a stimulus check to release financial burdens,” Erin Griggs, a junior at FAMU, said.

Throughout the pandemic many students had to travel back to their home towns, pay bills, buy groceries and in some cases, become essential workers so they could make money to sustain themselves since most weren’t able to get a stimulus check.

This can change this tax season for college students if they switch from dependent students to independent students. According to FAFSA, to qualify to be an independent student you must meet one of the following qualifications: be married (also qualifies if separated but divorced), at the beginning of the 2022–23 school year you will be working on a master’s or doctorate program, among other qualifications.

The student also must have worked in the year 2020 and filed their taxes on their own to be able to qualify as an independent student and receive the recovery rebate credit. The recovery rebate credit is for citizens who did not receive the first and second stimulus checks in March and January.

Once a student is not a dependent and files their 2020 tax return they can ask their preparer about the recovery rebate credit, which they should be eligible for since they did not receive prior payments.

“Everyone deserves money, especially in such adversity. The more help that can be given is the better considering how many people are struggling to make ends meet,” sophomore business student Delia Washington said.

The payment of the previous stimulus checks will be returned with the student’s annual tax return and they will be eligible for the third stimulus check that is projected for late March.